How It Works

The ABAMA Token gives you a smart, structured way to invest in breakthrough startups — without needing to manage the complexity of traditional funds or cryptocurrency systems.

Even though our full investor platform is launching soon, you can already reserve your allocation and fund your investment in the first round — Abama Alpha — today.

Your allocation is secured under full legal agreements, and your tokens will be issued automatically once the infrastructure goes live.

Everything is designed for clarity and ease — so you can focus on the opportunity, not the operational hassle.

And once you're in, you’re not left in the dark. From transparent fund deployment to real-time portfolio tracking and automated profit distribution, the ABAMA experience is built to give investors the control, visibility, and confidence they deserve at every stage of the investment lifecycle.

Step 1: Reserve Your Tokens and Fund Your Allocation

The first investment round — Abama Alpha — is now open for qualified investors. While the smart contract infrastructure and dashboard tools are being finalized, we’re already accepting investors through a secure, manual onboarding process.

Here’s how it works now:

-

Submit your interest via our [contact form] or reach out to our team

-

Complete identity verification and eligibility checks (KYC/accreditation)

-

Review and sign the investment agreement (delivered digitally)

-

Transfer your funds via bank wire to our designated account

Once funds are received, your token allocation is secured and will be issued as soon as the on-chain system is live. You’ll be among the first investors in Abama Alpha — and have full access to all platform features as they go live.

Step 2: We Build the Portfolio

Once your capital is committed, our investment team begins deploying funds into a carefully selected group of 10–20 early-stage companies across fintech, blockchain, and AI.

But this isn’t just human judgment. Abama uses a proprietary AI-driven investment model to guide our decision-making.

Our system scans thousands of companies globally, analyzing:

-

Financial performance

-

Market traction

-

Growth signals

-

Technical viability

-

Founder track records

-

Ecosystem trends

From this data, we generate risk-weighted scores and predictive insights — helping us identify the companies with the highest potential.

Then, our investment committee conducts traditional due diligence to confirm strategic fit, team quality, and scalability. This combination of data-driven intelligence and professional oversight removes emotion from the process — and adds precision.

We don’t chase hype. We don’t bet on instincts. We build a portfolio on logic, data, and long-term thinking.

Step 3: Lock-Up Period Begins

As with any early-stage investment, value takes time to grow. Each token round includes a 24-month lock-up period, which provides stability for the portfolio companies to scale.

During this time, you will receive:

-

Investor reports and portfolio updates

-

Previews of the investor dashboard as it goes live

-

Early access to platform features including performance tracking and voting

You remain informed and connected throughout the process, with ongoing visibility into how your capital is being deployed, which milestones are being achieved, and how each company is progressing — so even during the lock-up, you’re never left wondering where things stand.

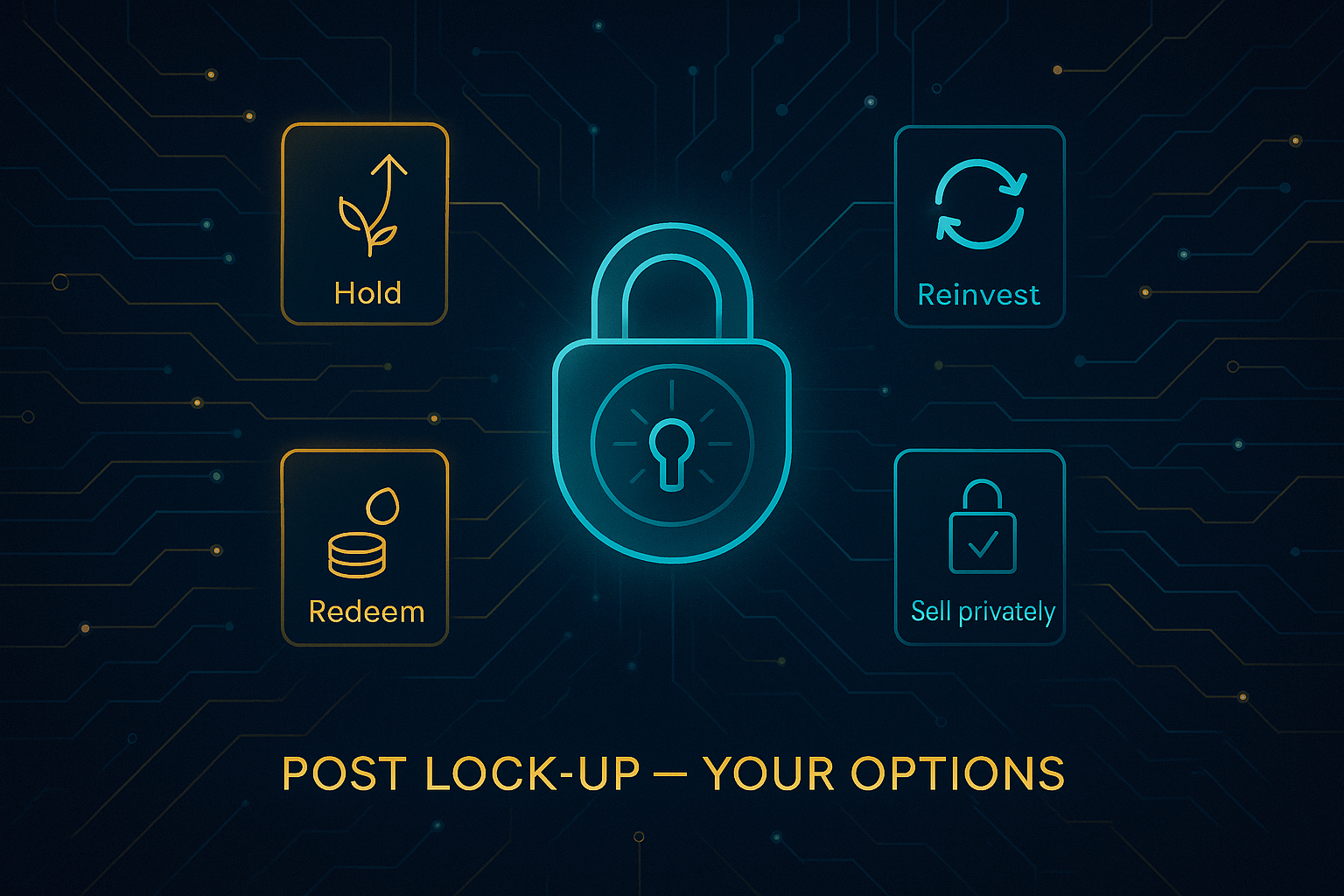

Step 4: Post Lock-Up — Your Options

After 24 months, you choose what to do next:

-

Hold your tokens to continue benefiting from startup growth

-

Reinvest into a new round (e.g., Abama Beta)

-

Redeem your tokens based on the current value (via structured liquidity events)

-

(Coming soon) Sell your tokens privately via our KYC-secured secondary market

Your rights, access, and flexibility are preserved — and all decisions can be made directly within the investor platform once live, giving you full control over your investment path with clear options, seamless execution, and no intermediaries standing in the way.

Step 5: Receive Returns

As portfolio companies succeed — through acquisitions, IPOs, or other exits — the profits are distributed to token holders based on their ownership share. These distributions will be processed automatically by smart contracts once activated.

Payouts will be made in:

-

Stablecoins (e.g., USDC)

-

Fiat-backed digital assets

-

Or reinvested into future rounds (if selected)

Detailed records will be stored in your investor vault for audit, tax, and compliance purposes — ensuring you always have secure, verifiable documentation of every transaction, distribution, and decision, with full transparency at your fingertips.

A Clear, Simple Investment Lifecycle

Even without technical knowledge, you’ll find the process straightforward:

-

Reserve and fund your tokens

-

We invest in selected startups

-

You hold for 24 months while value grows

-

You choose to reinvest, redeem, or hold

-

You receive your share of profits and distributions