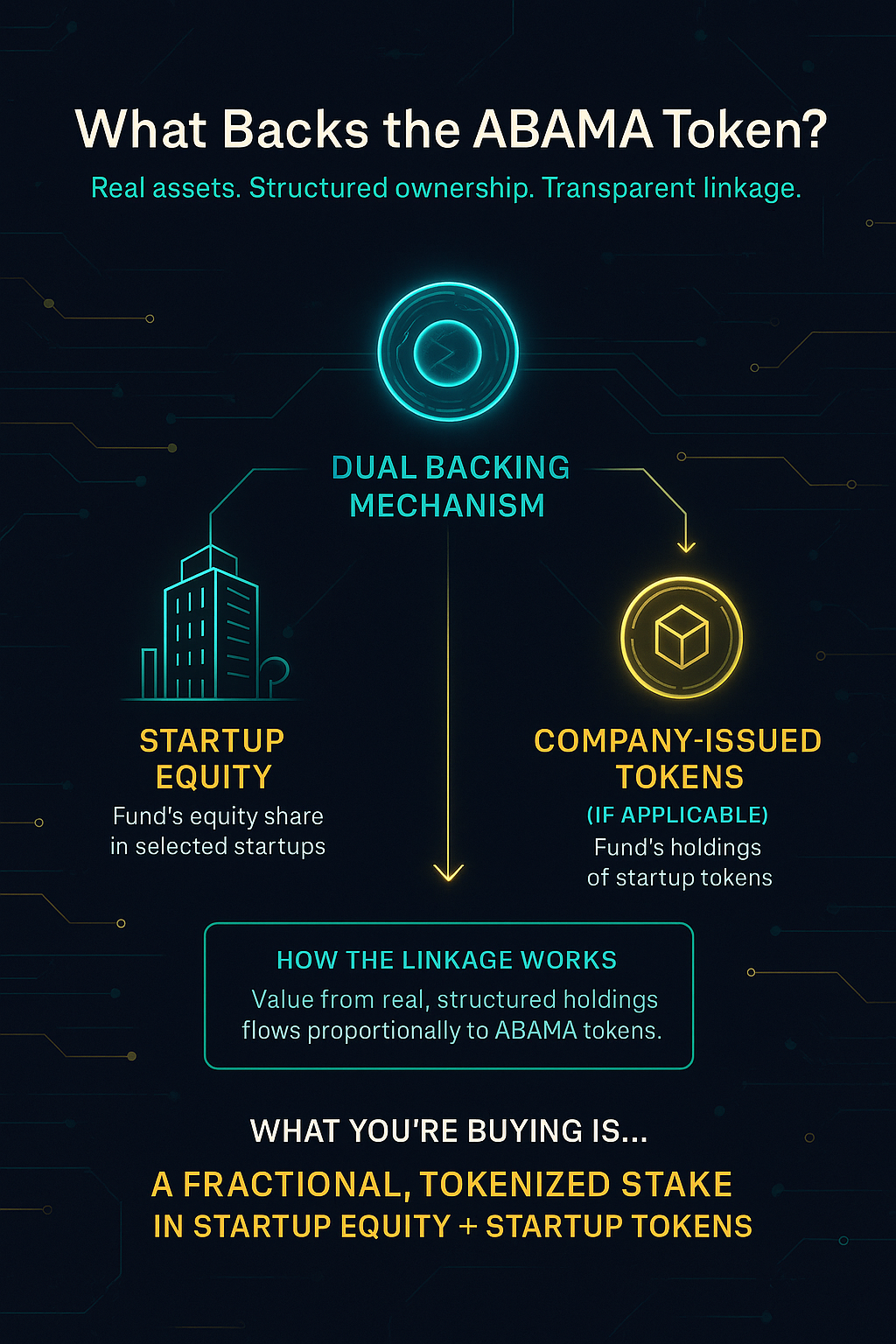

What Backs the ABAMA Token?

Real assets. Structured ownership. Transparent linkage.

What You’re Really Buying

Each ABAMA round operates as a tokenized micro-fund — built to deliver real exposure to startup performance without speculation, without noise.

You’re Not Buying a Utility Token

There’s no vague future access. No undefined platform rights.

What you’re buying is ownership — not participation.

You’re Not Relying on Hype

This isn’t about momentum trading, buzzwords, or market timing.

Each ABAMA token is tied to actual assets held by the fund:

-

Startup equity (through SAFE, convertible notes, or priced rounds)

-

Company-issued tokens (when available)

You’re Buying a Fractional, Auditable Stake

A smart contract ledger tracks your position.

NAV updates and performance data are tied to real-world events:

-

Equity raises, exits, IPOs

-

Token launches or buybacks

-

Company growth milestones

📦 Think of It Like This

Each token is your personalized slice of a structured, tokenized portfolio — built with institutional discipline, secured by compliance infrastructure, and tracked in real-time.

This is what asset-backed tokenization should mean.

Dual Backing Mechanism

Each ABAMA token issued in a given investment round represents a fractional, auditable claim on:

1. Startup Equity

We acquire direct equity stakes in the selected startups — typically through SAFE, convertible notes, or priced rounds.

-

These positions are held by a regulated investment vehicle.

-

ABAMA tokens mirror ownership in this vehicle on a pro-rata basis.

-

Equity performance (e.g. valuation increases, exits) flows back to the ABAMA token via NAV updates or distributions.

2. Company-Issued Tokens

In cases where startups issue their own utility or governance tokens:

-

We receive those startup tokens directly as part of our investment.

-

These assets are held securely and tied to the same round structure.

-

Future value (from token launches, listings, or buybacks) accrues proportionally to ABAMA tokenholders.

How the Linkage Works

| ABAMA Token | Backed By | Value Source |

|---|---|---|

| Your ABAMA token | Fund’s equity share in 10–20 startups | Valuation of startups (exits, raises, milestones) |

| Fund’s holdings of company-issued tokens | Startup token appreciation or liquidity events |